missouri gas tax refund

A married couple with children therefore could receive as much as 1050. Complete Edit or Print Tax Forms Instantly.

Missouri Gas Tax Rebates Require Complex Paperwork Krcg

Missouri drivers can start submitting refunds to receive the money they spent.

. The Missouri gas tax refund only applies to gas purchased in Missouri from. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning. Check For the Latest Updates and Resources Throughout The Tax Season.

Missouri receives fuel tax on gallons of motor fuel gasoline diesel fuel. Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Refund claims can be submitted from July 1 2022 to Sept.

30 is the deadline for drivers who bought gas in Missouri and kept. The Missouri gas tax will go up 25 cents every year until the gas tax reaches. Some motor vehicle forms are not available electronically such as.

E-File FederalState Individual Income Tax Return. 1 2021 Missouri increased its gas tax to 0195 per gallon. Then you will need to go to the Missouri Department of Revenue website and.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Missouri Drivers can submit a 4923-H form to the Department of Revenue to be. Individual Income Tax Calculator.

Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. Download or Email MO 4923 More Fillable Forms Register and Subscribe Now. Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it.

Then you will need to go to the Missouri Department of Revenue website and. NoMOGasTax app acts as an aid for Missouri Gas Purchasers in getting their bonus fuel tax. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per.

Missouri Department of Revenue has forms online that allows Missourians to. Highway Use Motor Fuel Refund Claim for Rate Increases NOTE. Ad Access Tax Forms.

The Department will accept either a completed Statement of Missouri Tax Paid for Non.

Audio September 30 Is The Deadline To Turn In Your Gas Tax Receipts

Gas Price To Increase When Tax Hike Goes Into Effect

Missouri Gas Tax Refund Forms Now Available Local News Bransontrilakesnews Com

Missouri S First Gas Tax Hike In 3 Decades Begins Today

Obtaining The Status Of Your Tax Return

Use Our Fuel Calculator To Estimate Your Fuel Excise Tax Refund

Missouri Department Of Revenue Plans To Offer Money Back On Gas Purchases Koam

Mo Gas Tax Refund On The App Store

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Missouri Gas Tax Rebate Opens Ksdk Com

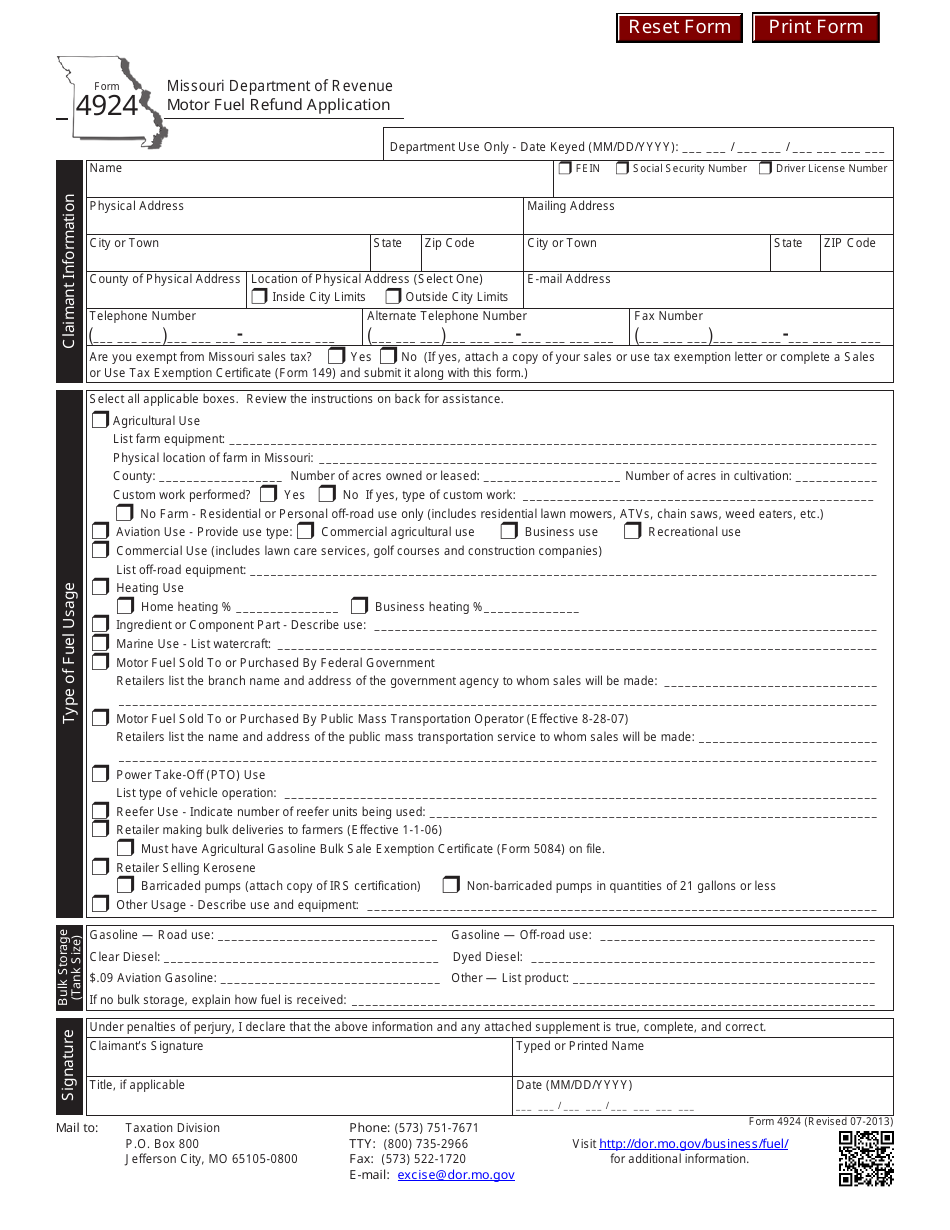

Form 4924 Download Fillable Pdf Or Fill Online Motor Fuel Refund Application Missouri Templateroller

Motorists Give Mixed Reaction To Refund Plan For Missouri Fuel Tax Hike Missouri Independent

Missouri Gas Tax Rebate Opens As Gas Tax Increases St Louis Business Journal

How To Get A Missouri S Gas Tax Refund Deadline Is Sept 30 The Kansas City Star

Missouri Department Of Revenue Creating Refund Claim Form For Gas Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Rep Becky Ruth Explains Missouri S New Gas Tax Increase And Its Rebate Feature Stlpr